The Recent Record High US Inflation Numbers and The Impact it’s having On Retirement

It’s no secret that record high inflation is here, and it’s not transient, as Fed Chair Gerome Powell said back in August of 2021. Investors across America feel the impact as rising prices outpace realized gains with raging inflation numbers.

Several companies help to protect your retirement income from currency devaluation. Here are the Best Gold IRA Companies in 2022

Those affected most by the increased inflation are those who are retired or about to retire. These readers either cannot or have a limited time to continue contributing to their retirement savings. Inflation is actively chipping away at their retirement savings and reducing their wealth. When inflation is eroding personal wealth on a massive scale, it is a time when wealth protection is paramount.

In a recent Global Atlantic Financial Group survey, 61% of “investors who are at retirement age believe that rising inflation and low-interest rates will make it more difficult to create an income stream to last a lifetime. “

Why is Record High Inflation and The Impact Is having On Retirement accounts so scary?

Inflation can be scary because of its devastating effects on the purchasing power in a retirement savings account.

Let’s break this down by the numbers:

Most retirement planning prepares a retiree to live on their retirement savings for an average of 30 years. For easy numbers, let’s use a retiree who has saved $2M in their retirement account at the end of their working life.

Without considering inflation, this person could easily use the 4% rule by withdrawing $80,000 per year with a modest 2% return and still have $304,000 in their retirement account at the end of the 30 years.

If inflation is an average of 2% and returns are still 2%, and only withdrawing $80,000 without adjusting for inflation over retirement, the retiree would run out of money in 23 years. Right now, inflation is 9.8%.

If this pace of inflation were to persist over the next 30 years and the retirement account only grew by 2%, the retiree would take no withdrawals from the retirement account. At the end of the 30 years, the purchasing power inflation would have reduced the retirement account to $161,302!

Understanding the Inflation Numbers

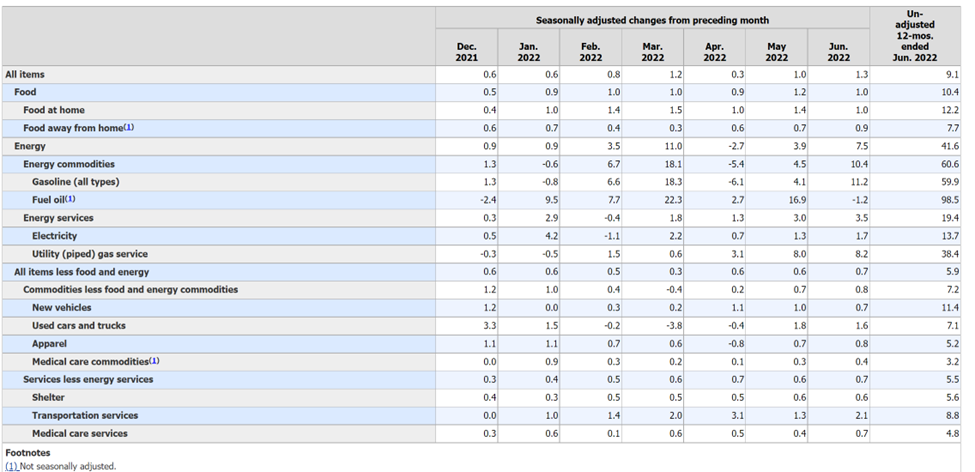

It’s good first to understand the current U.S. inflation numbers. As unadjusted, the inflation rate in the U.S. is increased by 1.3 % month over month, as this went just this month, June 2022, and has grown to a record year-over-year rate of 9.1 %. The U.S. Bureau Of Labor Statistics reports the U.S. inflation numbers.

The U.S. Bureau Of Labor Statistics takes market data and tracks a basket of commodity prices they deem necessary to consumers. The commodities include food, gasoline, energy prices, mortgage payments, new and used cars, and more. The average of prices each month is recorded and compared against the prior month’s and the subsequent year, providing the Consumer Price Index or CPI.

To see the latest BLS CPI number check out the BLS CPI site.

Some economists disagree with this method as commodities can be added or removed from the basket of goods based on how important the agency determines they are to the consumer at any given time. With a constantly changing basket of goods, deciding on the actual inflation rate can be challenging.

Looking at June’s Inflation numbers

As we look at the report in July showing June’s inflation numbers, we can see how the necessities such as food for home are above the 9.1% average. It costs families 10.4% to put food on the table at home over 1 year ago, which is a massive jump in food prices.

Individuals needing to travel for work are seeing an increase of 59.9% in Gasoline prices. It is reasonable to assert that the travel industry will eventually start seeing consumer spending habits change. Gas prices rise, and families feel the price hikes compared to a year earlier.

Inflation is called “The invisible Tax” due to its somewhat intangible effects on a savings portfolio. According to this BLS report, just to put some food on the table for you and your family this year compared to last, you need to have earned at least 10% more!

This 10% is just to break even. The slightly lower overall reported number of 9.1% is not much better.

An important question to ask is, when looking at your retirement portfolio, what was the average inflation rate used to calculate your retirement target?

Odds are it was a lot less than 6%.

How is the Federal Reserve working to keep inflation healthy?

The Federal Reserve is working to keep inflation healthy, but St. Louis Fed Chair James Bullard admitted in an interview back in May that the Fed. is behind the curve in reacting to the high inflation rates.

To keep from combat higher inflation rates, the Fed. has limited but powerful tools at their disposal. The most common one is raising interest rates. With the rising interest rates, the Fed makes money harder to get and forces businesses and consumers to pay off loans.

The Federal Reserve has a target of 2%-3% inflation, and once inflation climbs above the mark, it is the job of the Federal Reserve Board to raise interest rates. Back in August of 2021, Federal Reserve Chair Jerome Powell stated that inflation was transitory and would not increase the interest rates then.

It wasn’t till interest rates climbed above historic levels in the 1980s. James Bullard stated the last time CPI crossed over 5% was in the 1970s, which triggered 10 years of hyperinflation. At the time of his interview, Bullard does not believe we will see the prolonged high inflation as seen in the 1970s, but the Fed has to act carefully.

In June of 2022, the Fed raised interest rates by 75 basis points, the most the fed has raised rates at one time in nearly 30 years since 1994. As Inflation continues to grow, many economists are wondering what the July meeting will hold.

What does this mean for your retirement income?

As anyone will admit, you are most likely already feeling the effects of inflation on your everyday spending. There is a lot to worry about when considering life after your working years and being unable to contribute to retirement savings.

Those who are receiving social security benefits have had some relief. Thanks to the COLA act recently updated by congress, social security benefits received the most significant inflation adjustment in history. Inflation expectations for 2022 are leaving social security beneficiaries behind. Even with the inflation adjustment, these beneficiaries are still back where they started.

There are several inflation-resistant assets economists and elite investors are investing in, and one such hedge is physical gold.

A recent article Gold Hill Retreat pointed out how Wells Fargo and Bank of America are both bullish on gold, and now may be the time to buy.

Goldman Sachs is also bullish on gold, with an end-of-year target of $2,500, nearly 50% more than the current price.

source https://www.goldhillretreat.com/economy/inflation/record-high-inflation-impact-on-retirement/

.jpg)

No comments:

Post a Comment