Are you looking for a new investment opportunity? Gold Hill Retreat is your trusted resource for precious metals investment reviews. Our team of experts are here to help you find the best company to diversify your retirement savings with gold and silver bullion bars, coins, and more! We take a hard look at each company`s customer service, reputation, history of product quality, and much more.

Friday, July 29, 2022

How can you measure the effects of inflation on your retirement savings?

Watch video on YouTube here: https://youtu.be/T6fudw4y-3M

Monday, July 25, 2022

The Recent Record High Inflation Numbers and The Impact Is having On Retirement

The Recent Record High US Inflation Numbers and The Impact it’s having On Retirement

It’s no secret that record high inflation is here, and it’s not transient, as Fed Chair Gerome Powell said back in August of 2021. Investors across America feel the impact as rising prices outpace realized gains with raging inflation numbers.

Several companies help to protect your retirement income from currency devaluation. Here are the Best Gold IRA Companies in 2022

Those affected most by the increased inflation are those who are retired or about to retire. These readers either cannot or have a limited time to continue contributing to their retirement savings. Inflation is actively chipping away at their retirement savings and reducing their wealth. When inflation is eroding personal wealth on a massive scale, it is a time when wealth protection is paramount.

In a recent Global Atlantic Financial Group survey, 61% of “investors who are at retirement age believe that rising inflation and low-interest rates will make it more difficult to create an income stream to last a lifetime. “

Why is Record High Inflation and The Impact Is having On Retirement accounts so scary?

Inflation can be scary because of its devastating effects on the purchasing power in a retirement savings account.

Let’s break this down by the numbers:

Most retirement planning prepares a retiree to live on their retirement savings for an average of 30 years. For easy numbers, let’s use a retiree who has saved $2M in their retirement account at the end of their working life.

Without considering inflation, this person could easily use the 4% rule by withdrawing $80,000 per year with a modest 2% return and still have $304,000 in their retirement account at the end of the 30 years.

If inflation is an average of 2% and returns are still 2%, and only withdrawing $80,000 without adjusting for inflation over retirement, the retiree would run out of money in 23 years. Right now, inflation is 9.8%.

If this pace of inflation were to persist over the next 30 years and the retirement account only grew by 2%, the retiree would take no withdrawals from the retirement account. At the end of the 30 years, the purchasing power inflation would have reduced the retirement account to $161,302!

Understanding the Inflation Numbers

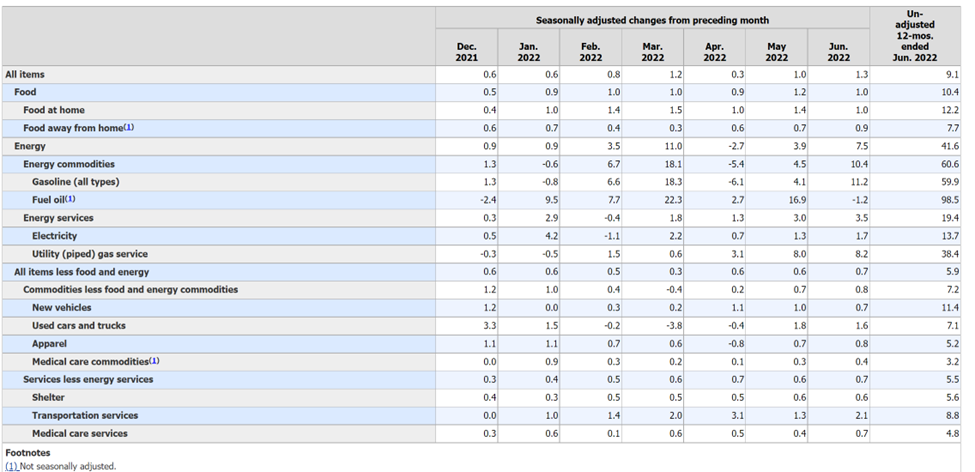

It’s good first to understand the current U.S. inflation numbers. As unadjusted, the inflation rate in the U.S. is increased by 1.3 % month over month, as this went just this month, June 2022, and has grown to a record year-over-year rate of 9.1 %. The U.S. Bureau Of Labor Statistics reports the U.S. inflation numbers.

The U.S. Bureau Of Labor Statistics takes market data and tracks a basket of commodity prices they deem necessary to consumers. The commodities include food, gasoline, energy prices, mortgage payments, new and used cars, and more. The average of prices each month is recorded and compared against the prior month’s and the subsequent year, providing the Consumer Price Index or CPI.

To see the latest BLS CPI number check out the BLS CPI site.

Some economists disagree with this method as commodities can be added or removed from the basket of goods based on how important the agency determines they are to the consumer at any given time. With a constantly changing basket of goods, deciding on the actual inflation rate can be challenging.

Looking at June’s Inflation numbers

As we look at the report in July showing June’s inflation numbers, we can see how the necessities such as food for home are above the 9.1% average. It costs families 10.4% to put food on the table at home over 1 year ago, which is a massive jump in food prices.

Individuals needing to travel for work are seeing an increase of 59.9% in Gasoline prices. It is reasonable to assert that the travel industry will eventually start seeing consumer spending habits change. Gas prices rise, and families feel the price hikes compared to a year earlier.

Inflation is called “The invisible Tax” due to its somewhat intangible effects on a savings portfolio. According to this BLS report, just to put some food on the table for you and your family this year compared to last, you need to have earned at least 10% more!

This 10% is just to break even. The slightly lower overall reported number of 9.1% is not much better.

An important question to ask is, when looking at your retirement portfolio, what was the average inflation rate used to calculate your retirement target?

Odds are it was a lot less than 6%.

How is the Federal Reserve working to keep inflation healthy?

The Federal Reserve is working to keep inflation healthy, but St. Louis Fed Chair James Bullard admitted in an interview back in May that the Fed. is behind the curve in reacting to the high inflation rates.

To keep from combat higher inflation rates, the Fed. has limited but powerful tools at their disposal. The most common one is raising interest rates. With the rising interest rates, the Fed makes money harder to get and forces businesses and consumers to pay off loans.

The Federal Reserve has a target of 2%-3% inflation, and once inflation climbs above the mark, it is the job of the Federal Reserve Board to raise interest rates. Back in August of 2021, Federal Reserve Chair Jerome Powell stated that inflation was transitory and would not increase the interest rates then.

It wasn’t till interest rates climbed above historic levels in the 1980s. James Bullard stated the last time CPI crossed over 5% was in the 1970s, which triggered 10 years of hyperinflation. At the time of his interview, Bullard does not believe we will see the prolonged high inflation as seen in the 1970s, but the Fed has to act carefully.

In June of 2022, the Fed raised interest rates by 75 basis points, the most the fed has raised rates at one time in nearly 30 years since 1994. As Inflation continues to grow, many economists are wondering what the July meeting will hold.

What does this mean for your retirement income?

As anyone will admit, you are most likely already feeling the effects of inflation on your everyday spending. There is a lot to worry about when considering life after your working years and being unable to contribute to retirement savings.

Those who are receiving social security benefits have had some relief. Thanks to the COLA act recently updated by congress, social security benefits received the most significant inflation adjustment in history. Inflation expectations for 2022 are leaving social security beneficiaries behind. Even with the inflation adjustment, these beneficiaries are still back where they started.

There are several inflation-resistant assets economists and elite investors are investing in, and one such hedge is physical gold.

A recent article Gold Hill Retreat pointed out how Wells Fargo and Bank of America are both bullish on gold, and now may be the time to buy.

Goldman Sachs is also bullish on gold, with an end-of-year target of $2,500, nearly 50% more than the current price.

source https://www.goldhillretreat.com/economy/inflation/record-high-inflation-impact-on-retirement/

Sunday, July 17, 2022

Protecting Your Retirement: How to Protect Your Retirement Savings from Inflation

Protecting Your Retirement: How to Protect Your Retirement Savings from Inflation

Many conservative male investors are worried about their retirement savings eroding by record-high inflation. Many savvy investors have been researching inflationary-resistant physical assets like gold or silver as a way to protect your retirement and how to protect your retirement savings from inflation.

In this blog post, we’ll discuss what inflation is, how it causes damage to a retirement portfolio and some ways to protect yourself from rising inflation. We’ll also discuss the benefits of holding on to some cash and purchasing physical assets that are inherently inflationary resistant. Finally, we’ll provide you with a conclusion to this blog post.

Thanks for reading!

What is inflation, and how does it affect retirement savings?

Inflation is the increase in prices for goods and services. Inflation decreases the purchasing power of money in an investment portfolio. It affects retirees on a fixed income by reducing the number of goods and services the retirement portfolio can purchase. Many retirees find it difficult to maintain their standard of living when the cost-of-living increases.

To offset inflation, the investment savings account should generate a higher return than the rising inflation rate. Unfortunately, many don’t consider inflation’s effects on personal finance until it’s too late.

You need to know that the higher the inflation rate, the more your investments must grow to keep up with higher prices over time. Even though your financial portfolio shows gains and a decent rate of return, the account’s value may have decreased.

Inflation is a measure of the rate of change in prices.

Inflation is an important economic indicator that measures the rate of change in prices. Most countries aim to have a modest inflation rate. The United States, for example, sought to have an inflation rate of 2-3%. Above 2-3%, the Federal Reserve Chair would have normally increased interest rates to make money more challenging to obtain and start cooling off the market to prevent a massive erosion of savings or requiring adjustments to social security payments for individuals on a fixed income.

The Consumer Price Index (CPI) program produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services to track inflation increases. There are separate indexes for two groups or populations of consumers: CPI for All Urban Consumers (CPI-U) is the index most often reported by the national media. At the same time, CPI for Urban Wage Earners and Clerical Workers (CPI-W) is the index most often used for wage escalation agreements.

You can hedge against inflation with certain investments

When it comes to inflation, a good investment can protect your money from losing value. There are a few types of investments that offer this protection:

- Stocks

- Bonds

- Cash

- Mutual funds

- Inflation Hedges

- Real Estate

- Physical Gold and other precious metals

Stocks, Bonds, Mutual funds, Cash

These first four types of investments are traditional staples for retirement planning and personal finance but usually don’t provide the best protection against market turmoil. While these are part of a well-diversified retirement portfolio, and except for cash, they have the propensity to keep pace with inflation as the market sees higher prices, these are subject to devaluation when the economy takes a downturn.

Inflation Hedges

Inflation hedges tend to be less desirable when the overall market is doing well. Investors tend to shy away from inflation, or recession-resistant assets is they usually don’t have the same high return on investment (ROI) potential as other assets. However, these are essential to personal finance retirement planning. Inflation Hedges can help preserve your purchasing power during economic downturns. Hedges are ideal when inflation rates are at record highs, as seen in 2022.

Real Estate

Real estate investments can help offset inflation, providing stability, increased equity, and income potential. It’s important to remember that real estate is not a guaranteed hedge against inflation and does come with risk.

Physical Gold and other precious metals

Gold is one of the original currency denominations recognized worldwide for its stored value. Financial advisers at large banks such as Well Fargo and Bank of America predict a massive increase in gold. Elites have used precious metals such as gold, silver, platinum, and palladium as natural hedges against inflationary risks in their portfolio.

It’s essential to have a diversified portfolio if you want to protect your money from the erosive effects of inflation over time. To diversify your portfolio means having assets like stocks, bonds, commodities, precious metals, and short-term investments in your retirement portfolio. These options provide some volatility, which is necessary for long-term returns.

How can you measure the effects of inflation on your retirement savings?

To account for inflation, you should adjust your retirement savings plan. One way to do this is by investing in low-risk assets and/or buying physical precious metals assets, indexed mutual funds, or exchange-traded funds. Indexed mutual funds and exchange-traded funds allow you to diversify your investments so that if one asset goes down in price, the others will still be up.

Inflation will reduce the purchasing power of your retirement savings

As mentioned above, inflation is the rate at which the general level of prices for goods and services rises, and it eats away at the purchasing power of dollars over time.

Even a low inflation rate can significantly impact future retirement income if it’s compounded over many years. For example, if you retired in 1980 with a $100,000 nest egg and annual 3% inflation rates, by 2010, inflation would reduce your buying power to the equivalent of $40,340.

Inflation can be measured by Social Security and certain pensions and annuities; however, there are no perfect measures of its effects on individuals’ retirement savings plans. Many experts agree that investing in assets such as the ones listed above has the potential to keep up with inflation and is an excellent idea to include in the decision-making process. Several inflation-resistant assets include stocks or mutual funds, TIPS (Treasury Inflation-Protected Securities), real estate securities, gold, silver, palladium, and platinum.

Inflation will reduce the real value of your retirement income

Retirees have relied on the 4 percent rule. According to many experts who say it’s an outdated strategy, this approach may not work in coming market cycles and more prolonged than expected time horizons. Even Vanguard has published information pointing out some holes in the retirement income plan.

Inflation and higher prices will reduce the real value of your retirement income, so you need to be proactive and make changes to your portfolio.

According to the 4% rule, the retiree should start with 4% of the retirement portfolio’s initial value. This number is based on research that suggests a retiree can withdraw 4% of their initial investment each year and then add the inflation rate to this amount every year to offset inflation effects and maintain the standard of living.

What are some strategies for protecting your retirement savings from inflation?

Hedge with Commodities

Financial experts often refer to investments that protect your savings from inflation as hedges. Hedges are investments that protect your property from falling dollar values. Inflation hedges are a good idea as long as they are mainly composed of commodities and not solely stocks or bonds.

Commodities have an inherent value, meaning their prices tend to rise with inflation. The strategy is most effective when used to purchase physical goods with a high liquidity rate like gold, silver, palladium, and platinum.

Self-directed IRAs can hold gold and Silver in a retirement portfolio through a self-directed IRA. See the 5 best Gold IRA companies.

Investors can use commodities to diversify and reduce risk and make their investment more secure.

Invest in Treasury Inflation-Protected Securities

TIPS is a type of bond which adjusts their principal according to the Consumer Price Index (CPI). TIPS is a popular means to offer protection against inflation. The principal amount is guaranteed upon maturity of the bond, so investors can be confident that their investment will not lose value over time.

TIPS investments are not impacted by rising inflation and higher prices. As inflation rises, TIPS adjust the price (principal amount) to maintain their real purchasing value rather than increase yield. Preserving the purchasing power makes them an attractive option for investors in times of high inflation who will live on a fixed income.

Consider Real Estate

One way to help protect your retirement savings from inflation is to consider investing in real estate. There are several options for investing in Real Estate. A popular option without taking on large amounts of debt is to invest in a Real Estate Investment Trust or REIT. When a REIT becomes a public company, all property-related income becomes exempt from federal income tax. Many focus on one property type, such as offices, apartments, or industrial sites. Some concentrate on mortgages only, while others diversify into several property types at once.

REITs are a way to invest in real estate without the tenant and maintenance issues that often come with being a landlord. The paid-out dividends will increase over time, which is helpful for investors looking to protect their retirement savings from inflation.

Create a Self-directed IRA to hold non-traditional assets in your retirement account

A Gold IRA, a self-directed IRA, is an individual retirement account that allows you to hold physical assets like gold, silver, platinum, and palladium. These assets can provide stability during times of market volatility and can help to protect savings from inflation.

What are the risks of inflation for retirees?

Retirees are especially vulnerable to the erosive effects of inflation. Not only do they have a reduced fixed income, but they also tend to have higher medical care costs than other age groups.

Estimations show that health care spending for seniors of retirement age is three times more than for working adults. Given these factors, it’s clear that retirees need to take steps to protect their retirement savings from inflation.

Inflation can have a negative impact on your retirement plans

Inflation can have a negative impact on your retirement plans. Retirees are incredibly vulnerable to inflation because they are past their working years, where they can actively generate income for everyday expenses. All they have left to pay for higher costs is the money they’ve put aside for retirement.

Your retirement savings won’t last as long if inflation eats into their value.

Even for many investors who have diligently saved for retirement, the high inflation rate is actively destroying your wealth. Without active planning to protect your account’s purchasing power, the longevity of what you have saved will only last a fraction of the time.

As Medical advances continue, people, on average, are living longer, well into their 80s, 90s, or 100s, making it likely that retirees will need to survive off their income for more than 30 years.

Inflation can increase the cost of healthcare.

Health care costs have risen quickly, but inflation is asseverating the issue. Retirees need more money now than ever to allocate for unexpected medical costs that can potentially wipe out their savings.

With so many people struggling to cover health care expenses, where are some tips on how to help combat the trend:

- Saving in a Health Savings Account (HSA). HSAs allow you to save money tax-free to cover qualified medical expenses.

- Purchasing long-term care insurance. This type of insurance can help cover costs associated with long-term care, such as nursing home stays or assisted living facilities.

- Retirement accounts also offer ways to plan for rising healthcare costs. For example, if you’re over 50, 401(k)s and IRAs allow you to save money more pre-tax by using catch-up contributions which can be used for healthcare expenses in retirement.

Finally, it is essential to remember that Medicare is not a comprehensive health insurance plan. Be sure to familiarize yourself with what your coverage entails once you retire and use that information to plan for the future.

How can you adjust your retirement savings plan to account for inflation?

Why aren’t you saving enough for retirement?

Many factors contribute to why someone might not be saving for retirement. Some people may lack knowledge about the best ways to save for retirement, while others may struggle with budget constraints or live in poverty. Additionally, some people may believe they will have enough money growing up until they retire, leading them to delay starting a retirement savings account. Finally, some people may not have any extra money to set aside from their regular income and Social Security benefits.

A study by the Economic Policy Institute found that, in 2013, the median retirement savings for all working-age families was just $95,776.

There is also a false sense of security that Social Security benefits will fill the gap many Americans need to live comfortably. After all, they have been paying into the program their entire career. According to the Social Security website, Social Security payments for a retired worker average $1,539.68 per month, and $1,539.68 is hardly a livable wage.

Some elect to delay Social Security payments to collect “Delayed Retirement Credits” and increase the payments by 8%.

Another reason Americans are not saving enough is the rising prices of essential expenses, and health care expenses are eating into discretionary money. According to Barclaycard, consumers show signs of the cost-of-living squeeze, which sees almost half of all the UK card transactions. Barclays notes that virtually all non-essential expenses have declined, ranging from furniture to sporting entertainment.

Consider health care costs

When planning for retirement, it’s essential to consider all the potential costs that come with it, including the rising out-of-pocket costs for health care expenses.

According to Senior Living, the average annual cost of a semiprivate room in a nursing home is $94,900, and the average yearly cost of assisted living facilities is $54,000. Home health care homemaker services run about $59,495 per year.

What are some tips for minimizing the effects of inflation on your retirement savings?

#1 way to protect your retirement is to Check your emotions!

One of the best ways to protect your retirement savings is to check your emotions at the door! When the markets are in turmoil, it’s easy to let fear or greed take over and make decisions based on those feelings rather than reason. Instead:

-

Asset-allocation funds have a diversified portfolio and target retirement dates. Having a target retirement date means the account will automatically rebalance its holdings when the market takes a downturn, so you don’t have to worry about making knee-jerk decisions.

-

Target-date funds put your savings on autopilot, with adjustments based on your targeted retirement date. Putting savings on autopilot takes the emotion out of decision-making, so you can be assured that your money is working for you even when you’re not paying attention.

-

Follow your investment strategy.

-

When retirement planning, make a plan with a fiduciary, someone who is legally obligated to act in YOUR best interests, not their own. This way, you can be sure that someone is always watching out for your financial well-being – no matter what happens in the market!

Save Early and Often

One of the best ways to minimize the effects of inflation on your retirement savings is to save early and often. You can do this by:

-

Contributing to a retirement account, such as a 401(k) or IRA. These accounts have tax benefits and allow you to save money pre-tax.

-

Diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate. Spreading more money across asset classes can help reduce volatility, improve returns, and insolate your wealth from adverse market events.

-

Open a Self-directed IRA with 3%-15% invested in physical products like Gold and Silver.

If you’re interested in learning more about investing in gold, Gold Hill Retreat has done extensive research on the top gold IRA companies

Review Your Withdrawal Strategy Regularly

When planning for retirement, it’s essential to have a solid withdrawal strategy in place. However, this plan may need to be revisited as time progresses and your circumstances change. For example, as mentioned above, the 4 percent rule may not be as reliable in the future – you may want to consider withdrawing 3 percent instead.

Additionally, if you are not comfortable with the CPI (Consumer Price Index), consider using the MSPRATI inflation index instead of relying on your retirement investments alone to ensure a steady income in retirement. And finally, remember that medical expenses will likely continue increasing. According to the Peter G. Peterson Foundation, Americans spend nearly $12,000 yearly on medical expenses. So make sure you factor these costs into your overall budget!

Keep an eye on the economy

It’s essential to be aware of the economy when retirement planning. The stock market has outperformed the CPI since World War II, so it can be a good idea to include stocks in your portfolio. However, remember that the market as a whole doesn’t always rise – it’s essential to plan your portfolio based on your individual needs. In addition, you should also include bonds in your portfolio for income and stability during market downturns.

Final Thoughts

While inflation does not cause your retirement savings to vanish overnight, Investors can not underestimate the damaging effects. Inflation causes make it essential for you to be prepared and aware of how best to mitigate inflation’s impact. Investing in assets such as precious metals like gold or silver bullion can ensure that your retirement funds are protected. To learn more about the best gold IRA companies, read our in-depth reviews to find out which company is right for you.

source https://www.goldhillretreat.com/economy/inflation/how-to-protect-your-retirement-savings-from-inflation/

Saturday, July 16, 2022

Monday, July 4, 2022

Are we Heading for a Recession? [Here’s What the Experts Say]

When it comes to retirement planning, one of the most important factors to consider is whether or not are we heading for a recession? In this blog post, we’ll look at what the experts are saying about the current state of the economy and what that could mean for your retirement plans.

Whether you’re already retired or just getting started, it’s essential to be aware of all potential risks and plan accordingly. So, read on for some insights from economic analysts and gauge whether you think a recession might be in our future.

Recession risks are high — uncomfortably high — and rising, a leading economist says

In June, the Federal Reserve (Fed) raised interest rates for the third time this year to curb inflation. This move was largely unexpected, as most experts predicted that the Fed would wait until later in the year to make any additional rate hikes. The reason for the Fed’s aggressive stance is inflation.

Inflation has been increasing steadily over the past few months. The Fed wants to get ahead of increasingly rising prices before we start to experience hyper-inflation that causes too much damage. However, some economists are concerned that these rate hikes will lead to a recession.

When interest rates go up, it becomes more expensive for businesses and consumers to borrow money. Making money more expensive is intended to decrease economic growth, forcing debtees to pay off their loans.

The worry many economists have is the inflation we are currently seeing is not a normal function of supply and demand. The inflation presently affecting the markets results from the poor economic policy set by Congress and the president.

The Federal Reserve is trying to use its tools to work in the constraints and counteract the bad economic climate the elected officials have created. Slowing the economy down at any rate while the policies are in effect could trigger a significant economic downturn.

As the economy contracts in this environment, many experts agree that the risk of recession is high.

“Risks are high — uncomfortably high — and rising,” said Narayana Kocherlakota, former president of the Federal Reserve Bank of Minneapolis.

Kocherlakota cited several factors that have led him to this conclusion, including increasing pessimism among market participants, soaring inflation, high prices, mortgage rates, and rising interest rates. He also pointed to global events like the coronavirus pandemic and Russia’s invasion contributing to increased uncertainty and risk aversion.

The U.S.’s economy is headed towards a downturn, while the rest of the world’s economies are also experiencing high inflation and high global recession risks, according to data from economists surveyed by Reuters.

Powell: Recession after rate hikes certainly a possibility

Jerome Powell, the Chairman of the Federal Reserve, testified before Congress on Wednesday and said that a recession is a possibility after the rate hikes. Acnologing that a recession is possible was a surprise to some people in attendance, as Powell had previously mentioned that he thought the economy was in good shape.

The latest interest rate hike was 75 basis points in June of 2022, something the Fed has not done since 1994.

Powell said that the central bank must move “expeditiously” to raise rates fast enough, so inflation doesn’t rise further (the CPI is currently at 40-year highs). If they downplay the pace of inflation in 2022 as they did in 2021, they’ll be too aggressive. Inflation assumptions are nothing more than people believing prices will increase in the future, and this can lead to all sorts of consequences for an economy, like accelerating wages.

The Fed is raising rates because of inflation, which will lead to lower economic growth, which could result in a recession. Given the high rate of inflation and an already slowing economy, consumers will have to reduce spending to compensate.

The Fed has raised rates three times this year and is expected to do so again. Many worries that if the Fed moves too aggressively, it could cause a recession.

Inflation is at a 40-year high, and many say it will take even higher interest rates to get it under control. The CPI (Consumer Price Index) is currently at 8.6%, well above the Fed’s target of 2%.

Powell’s comments come just days after Goldman Sachs issued a report saying there is a 70% chance of a recession within two years. The report cited concerns about high debt levels and weak business investment as reasons for their prediction.

The additional reduced spending at a time when our economy is so fragile is driving the recession fears.

A Growing Chorus Fears the Worst

As the saying goes, there is safety in numbers. And when it comes to fearing a potential recession, many business leaders and economists are singing from the same hymn sheet.

They cite concerns about rising debt, trade tensions, the slowing housing market, high inflation, and slowing global growth as reasons for their pessimism. Hopefully, this increased awareness will help policymakers take action before it’s too late.

In addition to reducing hiring, already affecting the job market, companies like Facebook-owner Meta are leaving certain positions unfilled due to attrition and “turning up the heat” on performance management. CEO Mark Zuckerberg warned workers that the economy might suffer a deep downturn.

Meta confirmed hiring pauses in broad terms last month, but exact figures have not previously been reported. The social media and technology company is bracing for a leaner second half of the year as it copes with macroeconomic pressures and data privacy hits to its ads business.

Chief Product Officer Chris Cox wrote in the memo that “we are in serious times here” and “the headwinds are fierce.”

Inflation and Recession Are Two Different Things

When it comes to money, it’s essential to understand the difference between inflation and recession. Inflation is a rise in prices for goods and services. At the same time, a recession is when the economy moves in the wrong direction, causing an extended period in bear market territory.

Inflation occurs when the average household spends more money on fewer goods and services. More money is needed to pay for necessities based on the value of money decreases over time. One reason may be that gas prices are rising in the U.S., reaching a new record high.

Many would like you to believe that the most significant contributor to higher inflation rates since 1981 has been rising gas prices. The inflation we are seeing now has been caused by extremely grotesque monetary policy coming out of Washington D.C. over the past two years.

Congress has been continuously finding reasons to print money and dilute the value of our dollar. Estimates that 40% of ALL the money the United States of America has ever printed in history was printed in the past couple of years.

As markets have started to open up and money flows, all this new money is finally circulating. To add insult to injury, Congress is sending Billions of dollars to the war effort in Ukraine. Ukraine is a country known for its corruption. Several United Nations members have stated as much.

A recession is defined by:

In a 1974 The New York Times article, Commissioner of the Bureau of Labor Statistics Julius Shiskin suggested several rules of thumb for defining a recession, one of which was two consecutive quarters of negative GDP growth.[6] In time, the other rules of thumb were forgotten.

Source: Wikipedia.org

Q1 of 2022 has already reported a negative Gross Domestic Product (GDP), signaling an economic contraction. From well-known economists to financial institutions are becoming vocal about recession worries. These articles can be found on Bloomsburg, Reuters, CNBC, and many other outlets.

How can we tell if we’re heading for a recession?

There are many ways to tell if we’re heading for a recession. One key sign is rising unemployment rates – when people can’t find jobs, that’s generally a sign that the economy is struggling. Another indicator is if it becomes more difficult to access credit because banks are worried about default rates.

The Federal Reserve is also raising interest rates to tame inflation, which could significantly impact the economy and consumer spending.

Recessions are typically associated with a spike in inflation and interest rates, leading to rising prices of goods and services.

As businesses pay more for raw materials, including payroll, consumer prices are increased, and the labor force is decreased to cover operational costs. This dynamic has yet to propagate through the financial markets fully.

What causes recessions?

Many different things can cause a recession. Sometimes it’s an overheated economy, asset bubbles, abnormally higher prices than actual market value, and occasionally unexpected economic shocks. The Congressional Research Service has identified three main factors contributing to recessions: overheating, asset bubbles, and unanticipated economic shocks.

Generally, there are two types of shocks that can affect the U.S. economy: demand-side and supply-side shocks. Demand-side shocks are changes in consumer spending or investment. For example, if the government decides to reduce military spending, that would be a demand-side shock because it would reduce overall consumer demand. Supply-side shocks are changes in production capacity or prices. For example, if oil prices increase significantly overnight, that would be a supply-side shock because it would change how much businesses could produce and how much they would need to charge for their products.

It’s important to note that these factors do not cause all recessions! A combination of several factors causes most recessions. And sometimes there isn’t one specific cause–it might just be bad luck or something entirely unforeseen!

What are the effects of a recession?

A few critical indicators can tell us if we’re heading for a recession. Usually, recessions last six months to two years or longer. The unemployment rate usually increases during this time, and borrowing costs go up. The Federal Reserve has raised rates more in 2022 than they have done for almost 30 years, so the cost of borrowing money is rising.

Increasing borrowing costs could lead to a recession in 2022.

One of the only bright spots is that during a recession, prices may fall.

How long do recessions last?

Recessions can last anywhere from a few months to a few years. The most prolonged recession on record was the Great Depression, which lasted for ten years. More recently, the 2008 recession lasted for 18 months.

A recession began in 2020 and will end by 2021, with the same one beginning in 2022 and ending by 2023. This information comes from National Bureau of Economic Research (NBER) economists, who use specific economic indicators to measure when recessions have occurred and ended.

One such indicator is high unemployment, which is when more than 10% of the workforce is unemployed. Another indicator is low wages, which means workers’ paychecks aren’t keeping up with inflation. Inflation occurs when prices for goods and services increase, making it harder for people to afford basic necessities like food and shelter.

According to Vox, the labor market is strong, and job openings have reached record levels. These indicators suggest that we are not currently in a recession–although there are some signs that one may be on the horizon. Job openings hit 6 million in July 2019, surpassing the previous record set in April 2001. The unemployment rate has also been steadily declining since 2010, reaching 3.7% in September 2019.

Recessions begin at the peak of activity and expansion before hitting their trough at the bottom of a downturn. The stock market is down, but most losses have been contained to a few hot sectors. For example, technology stocks have significantly declined in recent months, while utilities and healthcare stocks have been relatively stable.

What happens to stock markets during a recession?

It’s no secret that the stock market is a roller coaster. Sometimes it goes up, and sometimes it goes down. And during a recession? It usually goes down.

When an economy is in recession, we expect to see some significant drops in the stock market. For example, between October 2007 and March 2009 (the height of the last recession), the S&P 500 lost more than 50% of its value. That means if you had invested $10,000 in stocks at the beginning of that period, your investment would be worth just $5,000 by the end.

Of course, not every company will see losses during a recession, and some companies may even do better during tough times. But on average, we can expect to see a significant decline in stock prices when there’s a recession going on.

On the other hand, commodities have historically done well weathering a recession. Gold, for example, outperformed the S&P 500 severalfold. Check out the Best Gold IRA companies to protect your wealth.

What should you do with your money during a recession?

It’s essential to stay informed about what is happening in the economy to make the best decisions for your money. Experts say that we might be headed for a recession, and it’s a good idea to start preparing now.

Here are some things you can do to protect your finances during a recession:

- Save money for a rainy day

- Diversify your investments

- Invest in inflation-resistant commodities like precious metals

Gold and silver tend to fare well during a recession, so this could be a wise investment choice. Keep informed about the latest news and make intelligent choices with your money!

How do recessions end?

There’s no one answer to this question, as recessions can end in various ways. Sometimes they come to an end naturally, as the economy grows again and businesses start hiring more people. Other times, the government may step in and implement policies that help stimulate the economy. And sometimes, a financial crisis causes a recession to end abruptly.

Recessions end when a country’s economy begins to recover. They are usually caused by an overproduction of goods and services, which causes prices to drop and the demand for those products to decrease.

No matter how or when they happen, recessions always cause a lot of pain for people who are out of work or struggling financially. But hopefully, things will start looking up soon, and we’ll be on our way back to prosperity!

What lessons can we learn from past recessions?

It’s important to remember that every recession is different. Several factors will determine how bad the next recession will be and how it will affect us individually and as a nation.

Some economists predict that we’re heading for another recession, while others say we’re already in one. No one knows for sure what’s going to happen, but it’s always wise to be prepared.

If you’ve been through a recession before, it can be challenging. But you also know that there are things you can do to make it through OK. Here are some tips:

- Save as much money as possible

- Stay calm and don’t panic

- Keep your expenses low

- Look for ways to make extra money

- It might be wise to put that off for a year or two if you’re on the verge of retirement.

- Take steps now to ensure your assets are protected.

source https://www.goldhillretreat.com/economy/recession/are-we-heading-for-a-recession/

-

Are we in for a Global Recession? It’s a question on everyone’s mind: are we in for a global recession? And if so, what can we do to...

-

2022 Review of Augusta Precious Metals To learn more visit: https://www.goldhillretreat.com/inflation/hedge-against-inflation-with-augusta-...

-

GoldCo Review: Precious Metals IRA Investment Company 2021 GoldCo Overview Retirement is an exciting time in life but can also be a...

.jpg)